Recognized and featured across major financial platforms

Turning cutting-edge innovation into real cash flow

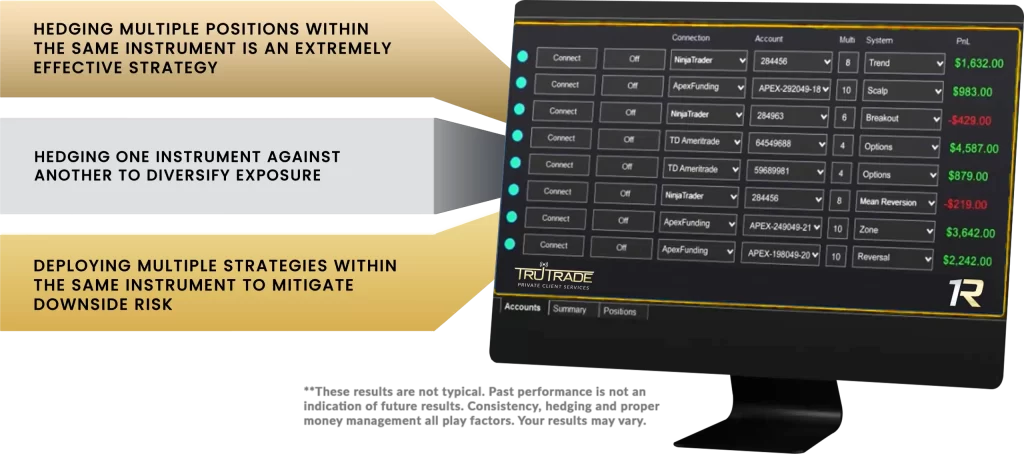

The animated chart above is provided solely to demonstrate the power of diversification. These results are not indicative of future performance. Consistency, hedging, proper money management, and market conditions all play significant roles, and individual results may vary.

The Problem:

Traditional Trading Creates Limitations

Most traders rely on:

- Limited capital

- Big market movements

- Manually executing trades

- Unpredictable market climate = Emotional trading

This outdated approach makes it difficult to navigate volatility, maintain discipline, or accelerate returns.

How does it work?

Professional Oversight + A.I. + Institutional Capital = The TruTrade Advantage

By fusing institutional funding with proprietary AI automation:

- Traders navigate turbulence more effectively

- Emotional decision-making is removed

- Systems adapt continuously to market conditions

- Opportunities can be captured instantly with sufficient capital

This synergy enables strategic, not reactive, trading.

The Solution:

QuickFund AI Eliminates These Barriers

QuickFund AI gives traders access to substantial trading capital, enabling them to diversify across multiple positions simultaneously. By deploying hundreds of thousands of dollars in tradable funds, users can take smaller, higher-probability trades with tighter risk control and far greater efficiency

Ready to Access Institutional Capital?

Quickfund AI guarantees you trading capital — giving you access to hundreds of thousands of dollars without risking your own money.

- Money-Back Guarantee*

- Trusted By Thousands

- Millions Invested into R&D

- World Class App available on Android and IOS

- White Glove Customer Support

- Easy to Use, One-Click Activation

- Guaranteed Funding Within Days

- Fully Passive Income Solution

We helped Izzy from McLaren secure more than 1 Million in Funding

With our QuickFund Services, you’re guaranteed access to at least $50,000 in tradable funds — or your money back.

The majority of our clients begin with ten $50,000 accounts, gaining access to half a million dollars in trading capital right from the start.

Copyright© TruTrade LLC 2026

TruTrade LLC, Danny Rebello, and Brian Nutt are not guaranteeing your success. Danny and Brian are experienced traders, and your results may vary based on your consistency in using the platform, and your ability to follow our recommended guidelines and market environments… Due to the sensitivity of financial information, we do not know or track the typical results of our client’s usage. TruTrade LLC, Danny and Brian’s automated platforms may not always be accurate, and their software may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you deploy their trading automation. Your results may significantly vary from theirs. We do not give investment advice, tax advice, or other professional advice.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

*TruTrade LLC is not endorsed by or affiliated with McLaren, Fox Business, Bloomberg, or CNBC. Mad Money, Halftime Report™, and Fast Money™ are properties of CNBC. Varney& Co, Cavuto, Making Money With Charles Payne, and Morning w/Maria are the property of Fox News.